Please note: As a business to business wholesaler, we only accept certain types of organizations as clients. If you are not a licensed business (Valid Business License), LLC (Certificate of Organization from the Secretary of State), Official charity (501.3C), church (Letter of organization or request), Public school (see accounting), Private School (business license), or other approved organization, you will not be able to acquire an account.

Georgia Sales Tax Exemption Form (ST5)

You will be prompted to “print” the ST5 form once it is completed. Choose to “save” the form as a .pdf, and you will then be able to upload it below.

PLEASE NOTE:

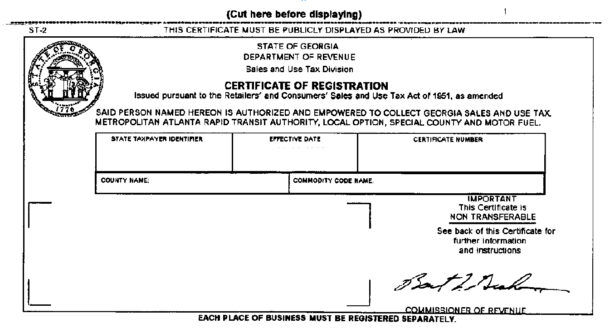

We require a copy of your ST2 which is the certificate you received when you registered to be tax deferred. (See example below)

We also require an ST5, which you can download and complete above. If you do not have an ST5 on file with us, you will pay tax. If you are not reselling the purchased items (you are the end user), you will be charged tax.

ST2 example: